Funding Models

Funding is required to enable every element of the Operating Model, but there are multiple challenges facing today’s Digital Operating models which can prevent them from delivering on the goals of the D-PROM. First is that many organizations have never truly integrated finance with an explicit strategy for technology value management. Instead, costs were attributed to projects or cost centers linked to organizational silos that were largely disconnected from the final products that were delivered. In practice, this meant business leaders could see the costs of technology projects and teams but could not correlate how those operational costs and investments created value for the organization or its customers. Value Management Through Product-Centricity detailed a framework for designating Digital Products and adopting product-oriented management across an enterprise, while Strategies and Functions described a common approach to modeling product TCO, as well as techniques and accountability for continuous cost-optimization as part of a broader strategy for product value management.

These two requirements of the D-PROM together solve the first challenge of digital finance, and establish an important set of operational expectations that open up entirely new funding strategies capable of tackling the second challenge. This second major challenge for integrating financial management with a product-centric Digital Operating Model is that traditional funding models rely on centralized planning, budgeting, and funding activities that typically require significant lead times to conduct, and can be even more cumbersome to update once in flight. These characteristics are in direct contrast with the goals of rapid innovation and agility reflected by product-oriented management.

Further compounding this general challenge are the real-world implications of the aggressive scaling of Agile teams by many organizations, and practices which leverage product and value-stream funding that soon collide with project approval funding and cost centers associated with elements of the products technology supply-chain. When these collisions between product-oriented and traditional funding models happen it can bring the speed of Agile-enabled product delivery to a screeching halt. This contradiction of funding activity goals and complexity of hybrid funding models unfortunately reflects the current situation for many organizations today, but can be permanently resolved at all levels by leveraging the D-PROM.

Continuous Product Funding

By adopting the D-PROM, business and technology leaders can rely on a set of operational expectations related to digital:

-

All digital-related expenditures across the business can now be distributed to Digital Product TCOs

-

All Digital Products are continuously managed for value

By shifting the focus of the Digital Operating Model to be product-centric, all future funding and investment conversations can now be truly value-oriented and not simply about project approvals and cost center allowances. In practice, this means that any products currently in the portfolio are delivering value, which means that business and technology planning conversations can now be transitioned from “how do these expenditures create value” to “which value delivering products should we invest in”?

Continuous product funding is a financial planning and management practice that derives from the principle that products, especially those developed by leveraging Agile principles, innately deliver value and, based on this reasoning, products in the portfolio may continue operating at their current levels of spending unless otherwise notified.

At any time, business and technology leaders can rationalize the entire product portfolio or simply one area of it, and decide to either re-prioritize a product, product line, or portfolio, update its spending and investment guidance, or even discontinue it, at which point the funds are re-appropriated. Otherwise, the product continues to be funded at its current level of delivery and performance.

More importantly, the end-to-end product-centricity enabled by the D-PROM alleviates the collision of product and project-oriented funding models. Now, all areas of digital operation can adopt a product-thinking approach and leverage the same continuous funding models.

Continuous product funding allows the Digital Operating Model to permanently transition away from operational budgets and project-based investments that were difficult to associate with business value and directly at odds with the Agile nature of successfully operating a digital business. While it represents a significant change, end-to-end continuous product funding fits naturally into the Digital Operating Model and directly supports its goals. It is important, however, for business and technology leaders to have a practical solution to drive overall guidance, and a mechanism for Product teams to facilitate spending outcomes.

Sliding Windows for Continuous Product Funding

Traditionally, technology managers might have leveraged quarterly bar charts to model the TCO for a service or solution. Business and technology leaders could approve projects and communicate quarterly or yearly budgets and spending limits, and Service Owners or technology managers provided actuals for the previous quarter and updated forecasts for future quarters. In practice, this approach was often too slow even for traditional technology management and, at the service level, could lead to costs and forecasting being largely overlooked outside of preparing a quarterly report.

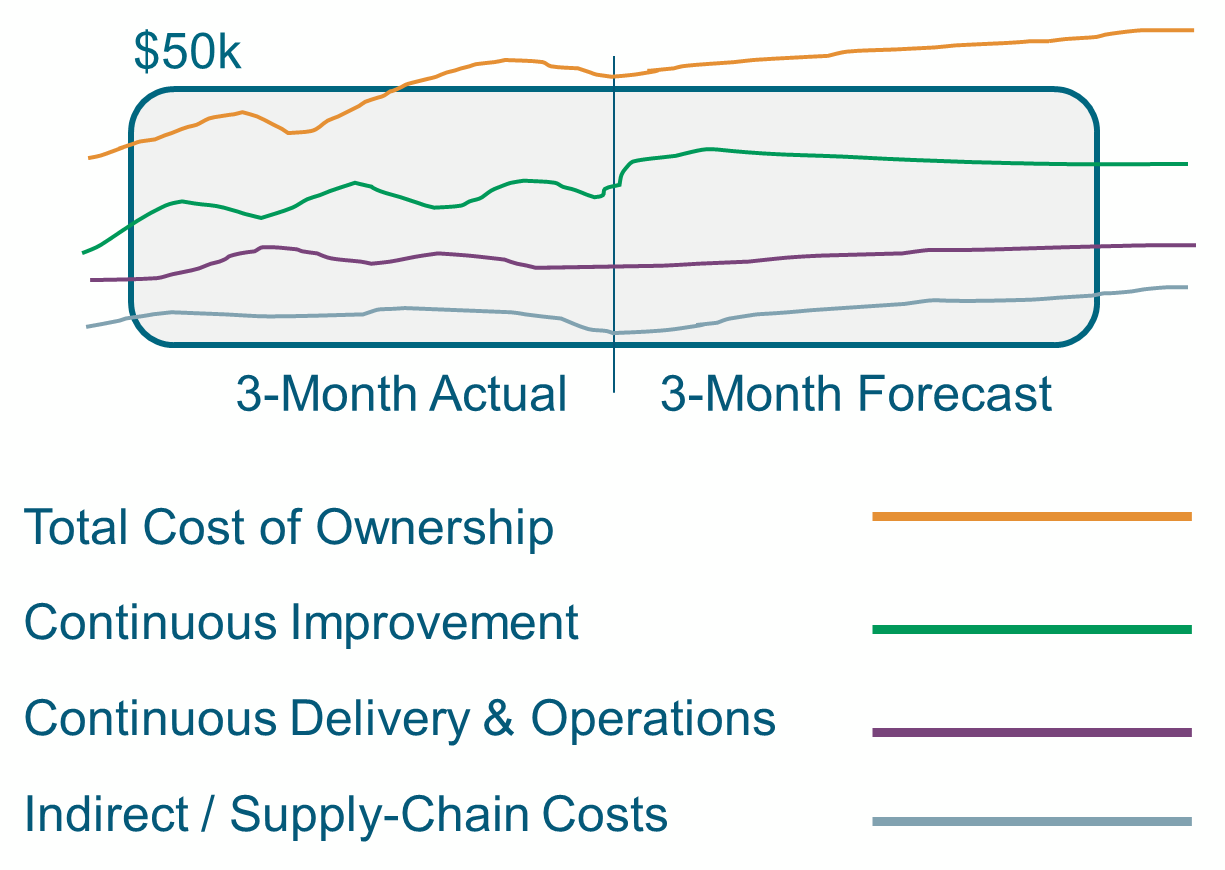

Instead of leveraging quarterly cost aggregations, Digital Product Managers will be more successful in driving continuous cost-optimization by leveraging sliding windows for visualizing and managing costs, as shown in Sliding Window Example for Continuous Product Funding. These sliding windows are also key in allowing senior level business and technology leaders to communicate overarching spending and investment guidance, set caps when needed, and steer innovation funding at the product, product line, or individual product level.

Sliding windows reflect a time-box fixed on the date or reporting at its center. The length of the window is pre-determined for the report, with equal periods for past actuals and future forecasts, and can be set to reflect two-week sprints, program increments or calendar quarters, or even longer periods reflecting development epics. The height of the window will typically reflect the TCO spending guidance, or an actual spending cap set for the individual product.

Spending policy can be driven in multiple ways; for example, requiring the approval of a Digital Product Line Manager to increase window height, or triggering a portfolio rationalization and spending strategy review if the total product spending is forecast to exceed the previously established window height.

Democratize Funding

Sliding windows or similar solutions not only help Product teams to apply a more continuous approach to cost management, but also allow for business and technology leaders to incrementally shape overall spending across a portfolio while still allowing for a high-degree of autonomy. Spending windows work like an ongoing allowance that can grow or shrink, depending on the business strategy. Also, note that the sliding window concept can be leveraged to aggregate and continuously optimize spending for a Digital Product line or portfolio.

Business and technology leaders can communicate guidance for innovation spending and priorities at the portfolio, product line, or individual product level, and guidance targets can be set for cost-types (overall product TCO, continuous improvement, continuous delivery, OPEX, etc). The “window height” of the continuous funding windows provides a mechanism for both overall TCO guidance as well as an allowance for innovation. These strategies leverage a mix of guidance and continuous funding window height across the common portfolio/implicit Digital Product-types:

-

External end-customer: window height is set well above the continuous delivery trend, or even above the historical TCO trend to encourage high-levels of innovation

-

Internal Line of Business: window height can be set above the continuous delivery trend, but with strict guidance that continuous improvement costs be leveraged to increase key performance areas or drive down continuous operations costs

-

Internal employee: window height is set just at the continuous delivery trend to encourage driving down those costs

-

Digital enabling: window height is closely linked to the forecasted trend with guidance that this is strictly to facilitate scaling, and associated with guidance or spending cap for continuous improvement funding

This approach allows business and technology leaders to steer overall investment and spending guidance, while still leaving Product teams with autonomy for the majority of cost-related decision-making. More importantly, end-to-end cost-optimization is achieved at higher levels than ever before along with investment steering to the right areas – all without subjecting teams across the business to a centralized, heavily bureaucratized process that can bring agility in digital innovation to a screeching halt.

Fund the Technology Supply Chains

It is critical that Product Managers maintain a constant vigil over their technology supply-chains and the costs of consuming internally delivered digital enabling products. These consumption costs are subject to fluctuation over time as the product is scaled and changed over time. Significant changes to a product may require additional investment or increased delivery costs from a downstream product or product line. Rapidly scaling or increasing product availability or adoption targets without proactively funding the technology supply-chain can result in bottlenecks and a decreased speed of delivery. Upgraded product performance targets may require additional labor, infrastructure, or support costs. New product capabilities may introduce new risks that must be evaluated, minimized, and audited.

Product delivery consumption costs can even spike unexpectedly, even when a Digital Product is not undergoing change itself. For example, newly announced zero-day exploits can trigger costs related to minimizing the risks associated with a number of Digital Products.

It cannot be stressed enough how important it is for a Product team to understand and manage the technology supply chain for a Digital Product, and that the supply chain itself represents a significant area of the product TCO and cost-optimization activities. In practice, this means regular engagement between Product teams not only for product roadmap planning, but for understanding the implications of costs in all product areas.

New Disciplines for Decentralized Digital Finance

It is important to consider here the implications of digital value management and the need for a broad, largely new discipline within the digital management space – roles, resources, and competencies for digital finance. Remember that Digital Products are becoming more complex, and intended for continuous delivery, continuous improvement, funding, and planning, all of which have associated cost and funding implications.

Consider the real-world challenge for Agile development teams in deciding when it is appropriate to capitalize the labor costs of a recently completed sprint that dedicated significantly less time to Q&A than planned. As another example, consider how Product teams would even begin to grade the cost-optimization of their cloud usage. These and many other complex scenarios can and will present themselves to Product teams, not to mention the complexity of continuous planning and funding of portfolios. In short, managing the value of Digital Products across a digital enterprise will rely on a decentralized community of resources disciplined in digital finance.

Below are some of the areas these resources are likely to support:

-

Digital Product Finance teams: these resources will primarily support Product teams in understanding, reporting, and optimizing costs from the product-perspective, and act as advisor to the Product Manager(s)

Resources may support general Digital Product finance advisory or focus on technology for financial domain-specific expertise such as FinOps or pricing models for external-customer product-types.

-

Digital finance control & audit: a pool of resources that can determine when digital delivery costs can impact company earnings (COGS, etc.), taxes, and reporting, help Product Teams identify controls, and then perform any required audits

-

Digital finance practice: reflects a central practice for governance, standardization of processes, tool selection, and education of digital finance across the business

Resources in this practice would likely also support continuous planning and budgeting efforts alongside leadership teams, and partner with business finance and procurement teams to shape relevant contracts. Finally, they should emphasize identification of opportunities to apply AI/ML, automation, and business intelligence capabilities to further enhance digital financial management across the enterprise.

-

Digital Transformation financial analysts: specialists that can analyze and advise on how proposed innovation will financially affect the value of a product

Competitive portfolio analysis and advanced scenario planning across disparate architectures are all areas these specialists could research and advise on above and beyond the typical Product team.

Individuals stepping into and ultimately shaping these disciplines will need to combine expertise in business finance with a continuously evolving understanding of the digital landscape, including the architectures, processes, and even operating models leveraged by the business.